Inflation stays hot as central bank response is key

Central bankers were dealt another headache on Wednesday when UK inflation for September was stronger than expected, headline inflation rose by 0.5% last month and by a whopping 10.1% in the last year. In Europe, the headline inflation rate was revised down a notch to 9.9% from 10%, however, both rates of inflation show that commodity prices have not yet peaked. Added to this, we are starting to see the second order impacts of energy price increases as it keeps upward pressure on fertiliser and transport costs. High CPI in the UK is also a symptom of a hollowed-out sterling and problems with the friction of trade. At the time of writing the UK’s tumultuous government looked like another pillar of the house of cards had fallen with the resignation of the Home Secretary; this makes it less clear if Liz Truss can last until the end of the week as PM. After three weeks of UK asset price gyrations caused by political factors, Wednesday is when economic fundamentals came back into play.

UK fiscal policy plays havoc with the asset price outlook

The inflation picture in the UK and elsewhere is looking more dismal, suggesting that the world’s central banks have not yet claimed victory over inflation. It also highlights the danger of rising underlying inflation pressure, even as the economy weakens. The BOE has a tricky path to follow in the coming months. Inflation is expected to rise again this month to 10.5%, before stabilising on the back of the government’s energy price guarantee. However, the guarantee will now end in April, which could push the headline rate of inflation to 11%. Added to the tax cut U-turns from the government in recent days, and the BOE needs to weigh up exactly how the government’s support for households will erode inflation. If the support is only going to last for 7 months, then the BOE should keep on raising interest rates, as the energy support guarantee does not materially change the medium-term outlook for inflation. The impact of fiscal stimulus on financial markets is complex. For example, while BOE rate hikes could cause UK gilt yields to rise, the fact that the government has limited its support for households, means that it won’t need to borrow as much in the coming year, which could limit the upside in bond yields. Thus, the future for UK asset prices is very unclear at present, which is why asset price rallies are fizzling out. For example, stocks have snapped their winning streak this week, US Treasury yields are surging, the 10-year yield is up 10 basis points, and the dollar is king once more– which is symbolic of a risk-off mood in markets.

Inflation risks to the upside, will central banks respond?

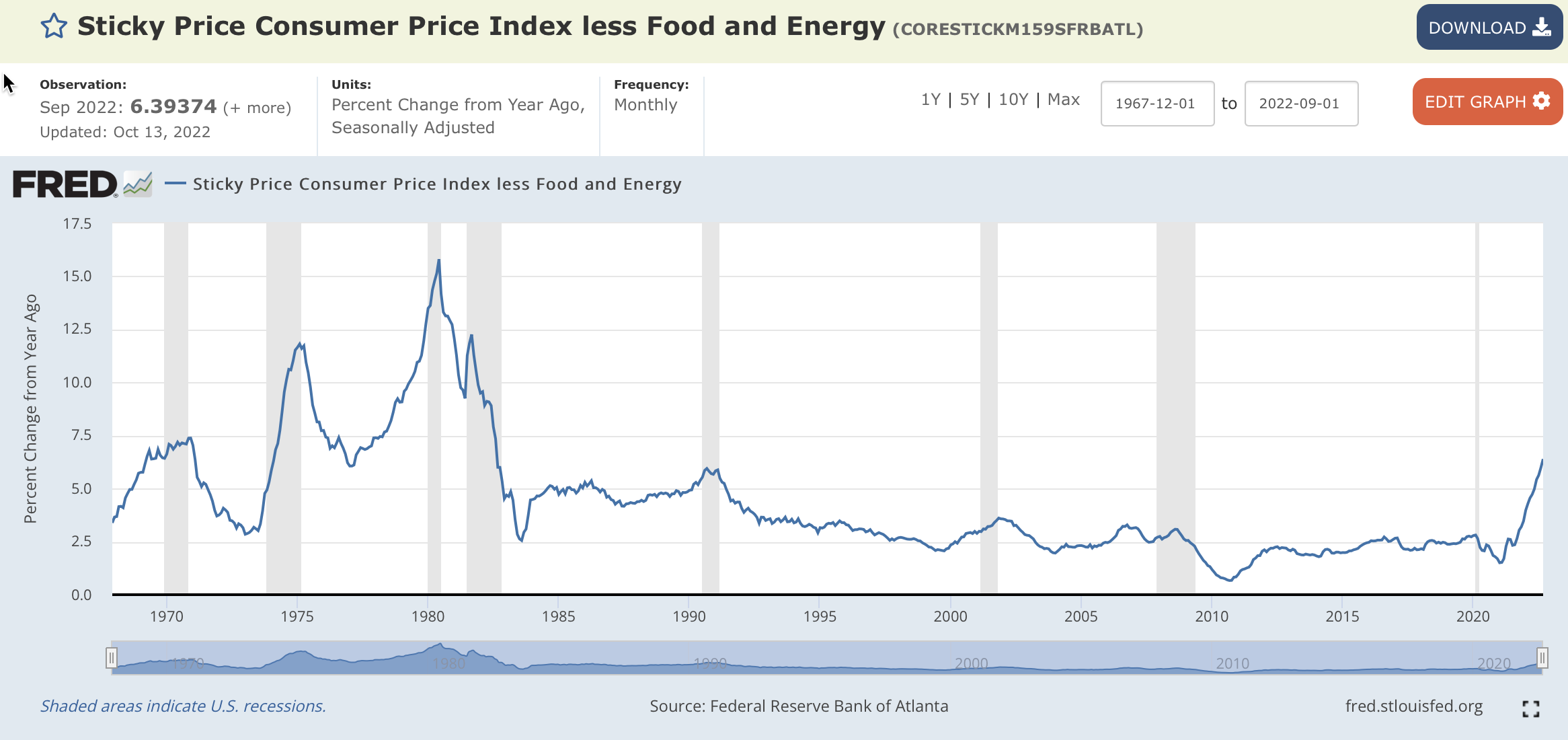

Looking ahead, we think that it is a dangerous assumption to make to think that we have already reached peak inflation and that the Fed’s terminal rate will be somewhere around 4.6%, as the last dot plot indicated. Core inflation across the world is proving to be extremely sticky, as you can see in the chart below. This chart shows the St Louis Fed’s sticky price consumer price index less food and energy. This is surging in the US, and has risen to 6.4%, its highest level since the early 1990s. The same is happening in the UK and in Europe, where core inflation is 6.5% and 4.8% respectively. The US is leading the way when it comes to core inflation growth, possibly due to the better prospects for the US economy, however, the consumer is strong around the globe, which is keeping service price inflation elevated. Therefore, we think that the terminal rate for both the UK and US could be revised higher in the coming weeks and months, with an upgrade to 5-6% likely before year end, based on the upside momentum in inflation.

Chart 1:

The current pace of increase in US Treasury yields, could see the US terminal rate get upgraded quickly. Fed speakers have done nothing to push back on 1, expectations of another 75bp rate hike in November and 2, that the terminal rate could move higher from here if there is not a meaningful improvement in the inflation outlook. Interestingly, there were increases in yields across the US Treasury curve on Wednesday, suggesting a significant uplift in yields is taking place, which could be the market predicting an increase in the dot plot when the Fed next meets in November.

The dollar remains king

Overall, what does this mean for asset prices? It means a stronger dollar and more volatility for asset prices. On Wednesday the stronger dollar has weighed on the pound and the euro, with GBP/USD down nearly 1% and EUR/USD down nearly 0.9%. USD/JPY has approached 150 on Wednesday, however there are rumours of official intervention to stem the yen decline, which is why USD/JPY upside has been stunted on Wednesday afternoon.

Later this week we will look in depth at earnings season so far, and what it means for banks. It is also worth noting that Bitcoin is back below $20,000 and is down a further 0.6% on Wednesday. This is a long-term support level that has held since June, and if we see further losses below the $20k level, this would be a technically significant event for the crypto-verse.