What goes up must come down

That is certainly true in the current environment. Wednesday’s sharp turnaround, which saw European stock indices surge, the Nasdaq 100 index had its largest daily gain since November 2020, oil retreated sharply, and EUR/USD rose back above $1.10. However, financial markets are closely tied to the Russian invasion of Ukraine, and after news that high level talks between the Russian and Ukrainian foreign ministers with no break-through and instead relations appear to be getting worse, market sentiment tumbled. Hopes that the first high level talks to bring this conflict to an end have been extinguished, added to news that this crisis weighed on US inflation, which rose to its highest level for 40-years last month, and the ECB delivered a surprise “hawkish” shock.

Expect the unexpected

This is a messy and rapidly changing market environment, and while we did see a countertrend move on Wednesday, it is looking like a relief rally, with the price of Brent crude moving back above $116 per barrel at one point on Thursday. However, the oil price made a quick turnaround after news that the US was close to an oil deal with Venezuela, which is an ally of Russia and is under US sanctions. The world is a strange place right now and predicting where prices will go is a fool’s game. Looking ahead, the Russian army look like they are on the move once again back towards Kyiv, a bloody battle for Kyiv could see further declines in risky assets as markets fret that Russia is getting close to defeating the seat of power in Ukraine. Financial markets are linked closely with this conflict, any escalation in fighting hurts risk sentiment and tends to lift commodity prices, which are also inversely correlated to risk assets right now. Overall, trading is tricky right now, and we would recommend short term strategies only.

ECB buys time

The ECB meeting on Thursday delivered a hawkish “shock” to the markets. The European central bank essentially said that war or not, it is moving ahead with ending its asset purchase programme sooner than the market had expected. It will taper its APP between now and Q3, when the programme will be brought to an end. The ECB was very clear, if “incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of our net asset purchase programme” then the programme needs to come to an end. Some had expected the ECB to remain reticent on changing policy when the outlook for European economy has darkened due to the disruption caused by the war in Ukraine. Some had expected Lagarde and co. to step back from policy change and instead highlight the fact that the surge in inflation was down to the war and thus something that they could not control. However, the ECB is reacting to rising prices, if they don’t then the consumer will suffer since even after large wage gains, real wage growth is now falling across Europe.

The impact of ECB shift

The reaction to the ECB statement was most keenly felt in the bond market, with German 2-year bonds rising 11 basis points. There is growing concern that spreads between German and Southern bond yields could surge once more. The Italian 2-year yield is now up 23 basis points on Thursday, and the spread between Italian and German 2-year yields is now approx. 56 bps. When these spreads widen, it suggests stress in southern European debt markets, something that we will be watching closely. We don’t think that the end of the ECB’s asset purchase programme will trigger a debt crisis in the Eurozone, and that’s because the ECB used this meeting to buy themselves some flexibility. While they have increased the speed with which they will wind up their bond purchases, they dropped their commitment to end asset purchases “shortly before” raising interest rates. Thus, we could have more time before we get lift off for Eurozone interest rates, and this is one of the reasons why the euro is coming under pressure as we move through Thursday. EUR/USD had jumped back above $1.10 on Wednesday, however, the ECB meeting combined with risk aversion across financial markets is weighing on the single currency, which had fallen below $1.10 at the time of writing. If sentiment towards the euro continues to sour, then we could see a return to the $1.0850 lows from earlier this week. This makes Wednesday’s market move look like a dead cat bounce, and due to the euro’s extreme sensitivity to events in Ukraine, we could see any rallies attract selling interest in the short to medium term. At this stage, the link between the Eurozone bond market and the single currency seems to be broken, and the euro is not moving in tandem with the sovereign bond market.

US price surge gives green light to Fed

The ECB’s Lagarde also mentioned that monetary policy can fight inflation, while fiscal policies can take care of growth in the current environment. Thus, central banks are unlikely to stray from their determination to fight inflation in the current environment, where price increases are becoming entrenched. This is also the case in the US and the UK. In the US, consumer price data for February surged to 7.9% YoY, the highest level for 40 years. The monthly increase was 0.8%, which suggests that inflation in the US is getting worse. Digging into the data did not give us much hope that prices will retreat any time soon. For example, food at home prices surged by 1.4% last month, energy costs were up 3.5% on the month and shelter costs rose by 0.5%, the annual price increase for shelter is 4.1%, which is the highest level since May 1991. Although there was some limited good news for second-hand car prices, which fell 0.2% on the month, the annual rate of increase for this sector is more than 40%. After this week’s surge in agriculture, metal and oil prices we expect to see inflation continue to rise in the long term, with former central bank forecasts that inflation would peak this spring now looking extremely outdated. The core rate of inflation is also at a near 40-year high at 6.4% YoY, suggesting that prices in the US are well and truly entrenched. Looking ahead, the rate of price increases will not start to go down until commodity prices retreat, yet that is unlikely to happen until the war in Ukraine stops, which does not seem likely.

50bps or not to 50bps

In wartime, it is harder to get inflation under control, and the latest US price data has seen Treasury yields rise once again. The two-year yield is now 1.71%, up nearly 30 basis points since Monday. The US yield curve is once again flattening, indicating the threat of recession for the US could be back on the cards. The 10-year yield is a little less than 30 basis points higher than the 2-year Treasury yield. While the market expects a 25 bp rate hike from the Fed next week, there is growing expectation that the Fed could hike rates by 50 bps in May due to the growing inflationary threat. There is now a near 44% chance that rates could rise by 50 basis points in May after a 25 bp hike in March, potentially pushing US interest rates up to 75-100 basis points in just two months’ time.

The impact on US asset prices

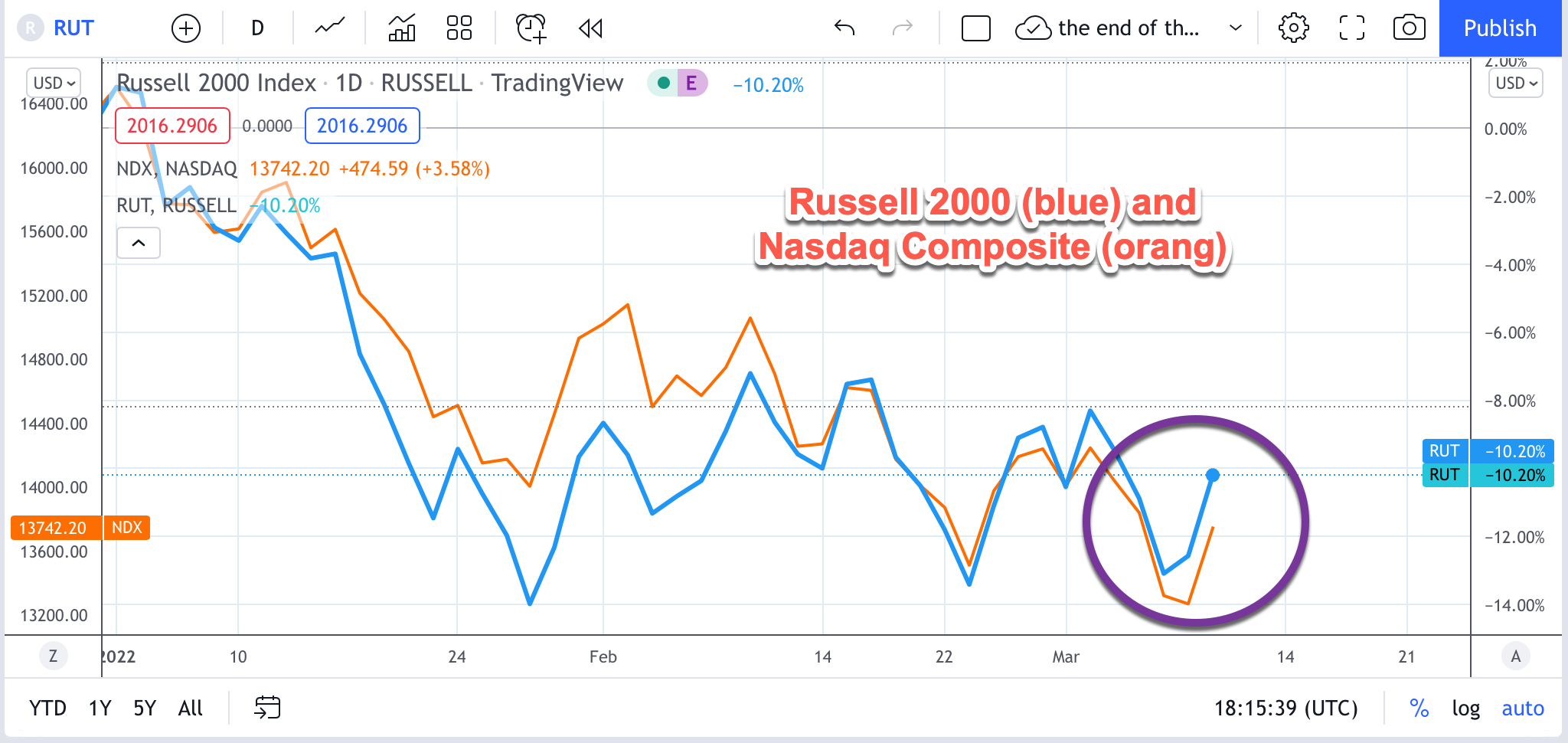

The USD is king once again, partly on the back of higher US inflation, but it is also benefitting from safe haven flows as volatility spikes. A more interesting development is occurring in the US stock market indices on Thursday. The small cap Russel 2000 index has started to outperform the Nasdaq 100. Not even surging inflation could stop its 2.7% increase on Thursday, in contrast to the 2% decline in Nasdaq Composite index. The reason for this is that the mega-cap tech index is an international index and is thus more closely aligned with geopolitical events and in particular sanctions against Russia. In contrast, the domestically focussed Russell is less exposed to events in Ukraine. Also, it will benefit more from an oil deal between the US and Venezuela, so we could see more outperformance of the Russell when / if this deal is announced. Due to this, we think that this outperformance by the Russell 2000 compared to the Nasdaq may continue for the short term.

Chart: