Why risky assets aren’t dead yet and what next for Netflix

It’s been a wild ride for financial markets this week, even though most of the market was out on Monday. The USD/JPY surged higher, US bond yields jumped, German producer price inflation rose to more than 30%, there was a collapse in Netflix’s share price, and those growth downgrades from the IMF. All of this must amount to a risk off environment, right? Wrong, European and US stock indices traded broadly higher on Wednesday, although the Nasdaq was lower, the USD is broadly lower and 10-year US Treasury yields are down some 9 basis points so far on Wednesday. We have said repeatedly that this cycle is different, and the rules that we have been used to don’t seem to apply in the current economic environment. The surge higher in US stocks on Tuesday was shocking, as was the outperformance of some of the most interest-rate sensitive sectors of the S&P 500 – consumer discretionary was up more than 2.9%, tech was up by 1.84% and real estate gained by 2.1%. So, has the market got ahead of itself? Is the war in Ukraine no longer such a threat and is the market comfortable in a high inflation/ higher interest rate environment?

Real yields: is positive territory really that bad?

We think the answer to these questions are yes, and no! This is not merely a non-committal answer from an analyst, our reason for this is mostly based on the US bond market. Earlier on Thursday the real 10-year yield, which is indexed to 10-year inflation expectations, attempted to move into positive territory for the first time since March 2020, however, it backed away from this important level and ended the session at -0.07%. The real yield remains close to positive territory, which is significant for traders. A positive real yield signals the end of lose monetary policy from the Fed and is also a sign that riskier assets like stocks could struggle in the coming weeks and months. However, it doesn’t mean that you should sell equities in a panic. A seasoned investment manager will tell you that the big risk for rising real yields is that one should reassess the value of owning businesses that may not generate profits for many years, i.e., the more speculative end of the market. When real yields are negative, that is when loss-making companies can see their valuations surge. Since late 2021, when real yields have started to move higher, loss making tech companies have fallen some 30%, while the S&P 500 is down approx. 7%. With only one rate increase, the Federal Reserve’s hawkish communications have seriously tightened monetary conditions and adjusted equity valuations. Thus, the question now is, how much further upside is there for yields? Earlier this week, Bank of America said that they were looking to buy Treasuries at the current level, which they deemed attractive because they anticipate inflation falling over the next 6-12 months. Thus, if yields have peaked and the lower quality stocks have already sold off, could we be close to a “nadir” for markets, even for lossmaking companies?

Why the US housing market is outperforming expectations

While financial conditions have undoubtedly tightened, there is some more good news for the perma bull. The 10-2-year Treasury yield curve has steepened quite dramatically after inverting at the end of March. This means that the risk of recession is lower than it was 3-weeks’ ago, and although the yield curve is still only + 32 basis points, a lower risk of recession is driving volatility lower. Added to this, there were two stunning pieces of economic data from the US this week: stronger than expected building permits and better than expected housing starts. With the 30-year average mortgage rate in the US at 5%, according to the St Louis Fed’s weekly data, the highest level since 2018, the market was surprised, to say that least, that the forward indicators for the housebuilding sector were so strong. This has led to a re-evaluation of how likely a recession is in the US. It is worth noting, that the average mortgage rate in the US peaked at around 5% back in 2018, could the same be happening this time? Instead of seeing 5% as a threshold that, if broken, could lead to much higher rates, will it mark the top for mortgage rates in this cycle? While the bulk of financial analysis concentrates on the Treasury yield curve and benchmark 10-year rates, perhaps we should all be focussing on mortgage rates, after all this is what matters to the consumer, since housing is more than 50% of global wealth. If US mortgage rates stabilise around the 5% mark, and if the US housing market does not collapse, then maybe the US householder can cope with 5% interest rates, partly due to the excess savings rate that they have accumulated since the pandemic, the economy continues to expand, and the US manages to avoid a recession even if the rate of growth slows, as was evident in the latest IMF global growth forecasts?

The bond market: reasons for optimism

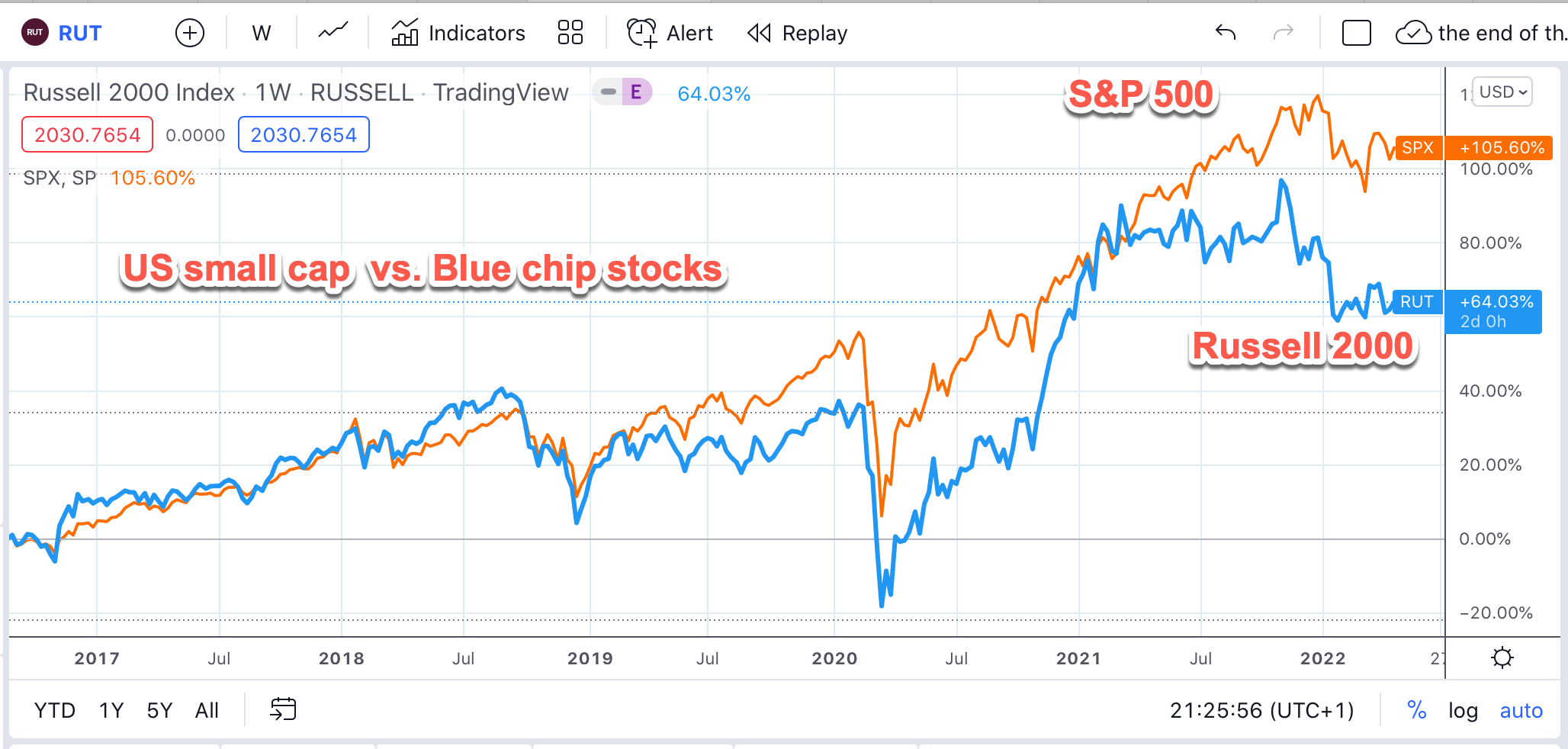

To sum up: a steepening yield curve, stabilisation in the 30-year US mortgage rate around 5%, a 5-year Treasury yield that stays around 3% (and is a good indicator of the Fed’s terminal rate), along with longer term inflation expectations in the US below 3% could mean a soft landing for the US economy, and thus the global economy, in the coming months. From a trading perspective, this is good news for domestic indices in the US. The chart below shows the Russell 2000 and the S&P 500 index, this could be the time when the Russell plays catch up with blue chip US stocks. Added to this, it could be good news for some unloved sectors of the S&P 500 such as the consumer discretionary sector and the tech sector, particularly if the Fed’s terminal rate does not pick up further from here

Chart 1:

What next for the dollar

When it comes to FX, the dollar has risen too far, too fast in our view and could be due a pullback, especially USD/JPY. That is why we have seen the US dollar index drop approx. 0.7% so far on Wednesday. We expect further losses for the greenback, potentially back to the key 125 level in USD/JPY. However, in the long term the dollar is still the king of the G10 FX world in our view, for a few reasons: 1, the US economy is strong, 2, it is less effected by the impact of the Russian invasion of Ukraine and 3, the Fed is still likely to hike rates at a faster and more aggressive pace than the ECB or the BOE. Added to this, there could be some volatility in EUR/USD in the coming days as we wait for the outcome of the French election, which if won by Marine Le Pen could cause wild downward swings in the euro.

Streaming services and the rise in risk premiums

Before we sign off, we can’t forgo a mention of Netflix. It eventually fell by a massive 35% on Wednesday, however, post-market trading suggests that it could claw back some losses on Thursday, but only to the tune of 0.36% so far. Enough has been said about subscriber loss and competition in the streaming sector, however we think there are two lessons to be learnt from this report: 1, subscriber-model consumer discretionary items should come with a higher risk premium, therefore we don’t anticipate Netflix rising back to its near $700 peak anytime soon, if ever. Disney and Amazon are exceptions to this due to their diversified business models. 2, the sharp selloff in Netflix’s stock does not signal a recession. Inflation is forcing consumers to make rational decisions, multiple subscriptions to various streaming services is not a good idea, it does not enhance our life and a clear out of our direct debits occasionally is a good thing!