New Year Cheer: is everyone too negative?

Reading through the annual investment bank predictions for 2023 was a gloomy business. The herd mentality is that stocks will fall, and the macro picture will be depressing. Have we ever had a more widely signposted global recession? However, while there are reasons to be cautious and we do expect volatility to be elevated this year, is there a case to be made about embracing that volatility? We think yes, and so far in 2023 there have been some important upside surprises that could lead to a rethink about the gloomy outlook for the UK and the global economy in 2023.

Below we consider four reasons to be cheerful for 2023

1, Inflation

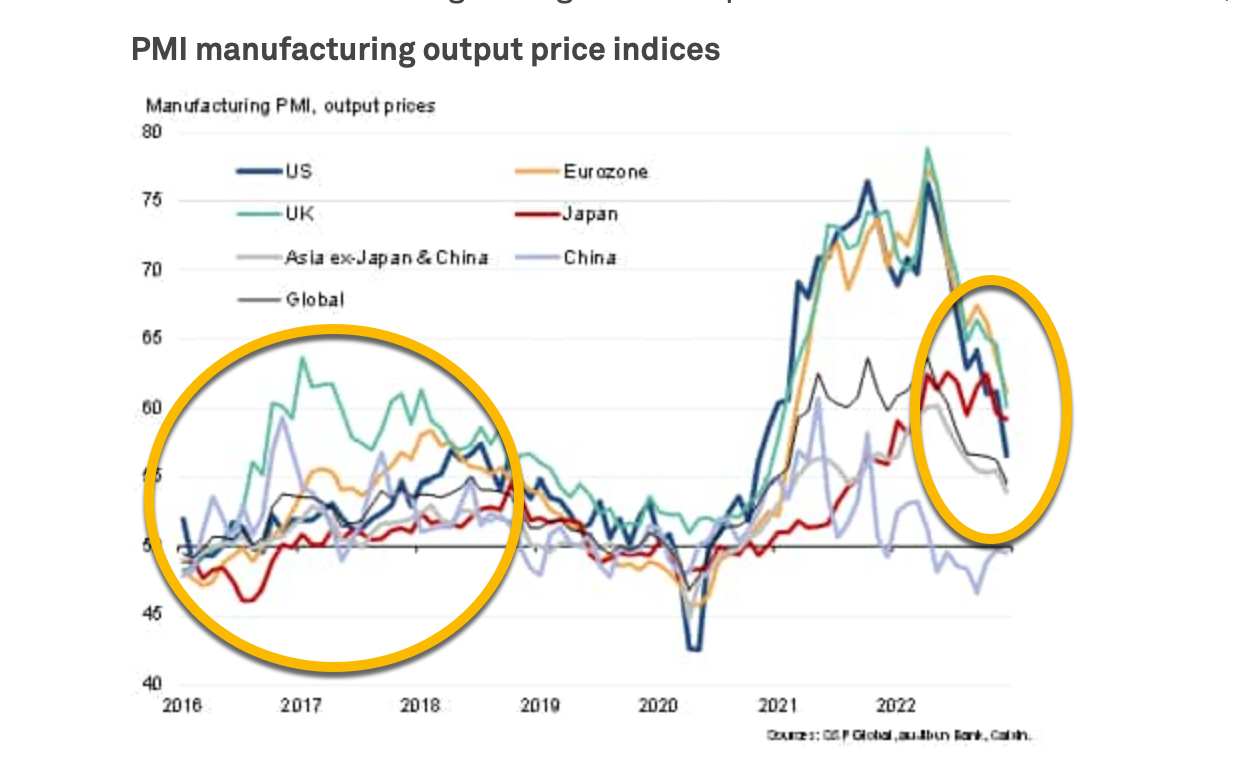

The peak inflation narrative from the end of 2022 is starting to look like it is justified. The inflation picture is easing across the world. This was clear in the December PMI reports released by S&P Global earlier this week. Manufacturing input prices around the world are coming down, as you can see in the chart below, and that is to be celebrated.

Chart 1:

Of course, inflation rates were likely to fall this year, however, they appear to be falling faster than people predicted. In Germany, the EU harmonised inflation rate fell 1.2% MoM for December, the largest monthly decline since 2015. “But what about core inflation, or sticky inflation?” I hear you cry. Well, service price inflation is also likely to come down in the coming months, and this is all because of energy prices. Energy prices make up a significant chunk of service price inflation, so while service prices are less likely to turn negative, price increases could shrink in the coming months.

Europe has had an exceptionally mild winter so far, and temperatures are well above average. This has had a stunning impact on energy prices. For example, in the UK, there has been a broad-based fall in the 2-year UK gas curve, it is now sub £2/ therm, down from £6/ therm in September. Wholesale prices should translate to lower retail prices with a lag. This is significant for many reasons: it should lower the cost of the energy support package and reduce some of the expected Gilt issuance this year. Added to that, it reduces the cost of living, which could benefit household spending and thus the economy. The picture is similar in Europe, NatGas inventories have soared in the middle of winter, largely down to the warmer weather. Added to this, electricity prices are now back at their pre-February 2022 levels, having eroded the 300% price spike between June and September. The winter of discontent hasn’t materialised, and fears that started to brew in the late summer are, for now, not materialising. It is early in the winter, and there could be plenty of colder days and weeks ahead, but for now this is a positive, and markets will be buoyed by this good news.

2, UK consumer strength

The first few retail trading updates of the year have been positive in the UK. Next reported Christmas trading on Thursday, and its shares are up nearly 9% at the time of writing. The retailer raised its profit forecast and said that it expected its cost inflation to peak this year, even if it plans to hike prices on its spring and summer wares by 8%. Its full price sales in the 9 weeks to the end of December were up nearly 5%, better than the 2% decline it had predicted. It also noted that online sales were weaker compared to last year, with in store sales up 7.5% vs. 2021, most likely due to the wave of covid that struck the UK at the end of 2021. Next raised its profit forecast for the year to January 2023 to £860mn, up £20mn. There was better news, the company is also expecting full year 2023 sales to fall 1.5%, the market had expected worse, and the pre-tax profit is expected to be £795mn, better than the £780mn expected by analysts.

This suggests that Next is resilient to the macro headwinds, or maybe the market is too bearish about the outlook? Afterall, energy prices are coming down, wages have been rising and household balance sheets are strong. The weak pound is still playing into cost inflation, with Next purchasing merchandise for Spring at a GBP/USD rate of $1.27, vs. $1.39 last year. This suggests that the hangover from the disastrous Liz Truss premiership is still being felt. The good news on the inflation front is that Next expects its inflation to fall next year, so price rises may be temporary.

3, Goods retailers are bouncing back

Another good news story for the FTSE 100 was the announcement that discount retailer B&M had a good December and was upgrading its full year profit forecast; it also announced that it would pay a pre-announced £200mn dividend in February. Sales in the 13 weeks to Christmas Eve were up 10.4% in the UK, and sales in France were a whopping 24.9% higher. Its chain of convenience stores also saw a large sales increase on 2021. The interesting thing about B&M is that it sells ‘goods’ that fell out of fashion in 2022 when the consumer switched from goods purchases to service expenditure. Thus, the fact that B&M had a stellar Christmas period is also a sign that the consumer is back.

Ryanair also upgraded its earnings forecast as demand for flights beat expectations for Christmas and the New Year, and its flights surged 10% on Thursday. In its current financial year ending in March, it is expected to report profit after tax of EUR 1.325BN to EUR 1.425bn, up from its previous guidance of EUR 1-1.2BN.

4, The Fed:

The FOMC may have issued minutes that struck a hawkish tone, but if you read between the lines, they’re sticking to the same play sheet that they have been working from since March 2022. The minutes of the December meeting underlined the Bank’s mission to stamp out inflation, they also urged the market to be cautious and not to expect rates to fall too fast. However, crucially, they also didn’t give any clues about the size of their next rate hike, saying that decisions will be made on a meeting-by-meeting basis. Thus, in our view, the Fed is watching the drop in energy prices and inflation, however, they are not willing to commit any dovish thoughts into forward guidance yet. The dovish pivot is coming, although it may not come until mid-2023.

Is jump in credit card spending a sign of UK consumer confidence?

As you can see, there are reasons to be cheerful at the start of 2023, but we need to see if this lasts and if it changes the narrative when it comes to the outlook for stocks and corporate earnings in the coming months. In the interest of balance, it is worth noting that credit card borrowing in the UK exploded in November, just in time for a Christmas shopping spree. The Bank of England reported that lending to consumers rose £1.5bn in November, of which £1.2bn was a jump in credit card borrowing, the largest monthly increase since March 2004! These figures are not adjusted for inflation, but even taking account of high levels of inflation, it still suggests that consumers are willing to take on debt to fuel spending. Is this a sign of economic confidence? We shall have to see. For now, the better corporate news has lifted the FTSE 100, which is up 0.6% on Thursday, and benefitted other retail stocks including M&S, H&M, Tesco, and eBay, which are all higher today. Gold is lower by more than 1% as the Fed talks tough on inflation, this has also boosted the dollar, and GBP/USD is down more than 1%, while the dollar is the king of the G10 FX space on Thursday.